Real estate is very important part of the economy which includes properties, land, and structures. It actually does not matter that although if you’re going to buy, sell or invest, understanding the fundamentals is much important.

Root Concepts

Below is a detailed table summarizing key concepts in real estate:

| Concept | Description |

| Property Types | Commercial, industrial, residential, and land properties. |

| Market Value | The selling price of something in the market. |

| Mortgage | A loan that is used for real estate business. |

| Deed | Legal document that transfers the ownership of a property to someone else. |

| Zoning | Regulations that dictate land use in specific areas. |

| Appreciation | Increase in property value over time. |

Understanding these terms helps navigate transactions and investments effectively.

Real Estate Transactions

- Buying: Research properties, obtain financing, and conduct inspections.

- Selling: List your property, negotiate offers, and close the deal.

- Investing: Analyze potential returns, manage properties, and monitor market trends.

Investment

Investment may be active or passive. Active investment involves purchase and management of properties while passive investment is indirect investment i.e. through funds. Both offer opportunities for wealth accumulation and modification.

If individuals are successful in understanding the core of real estate, then he’ll surely secure to make informed decisions, whether buying, selling, or investing. Furthermore, understanding of investment strategies is the only way to prove yourself among the great businessmen.

How to Make Money from Real Estate

Real estate investment not only provides surety for generating wealth but also maintain financial stability of the business. Whether you want passive income, it proves to be great.

Although it is the fastest way for quick and heavy profit but not such easy. The understanding of the strategies is the only way to proceed in the business but it proved to be quite tough. tips.

Understanding Real Estate Investment

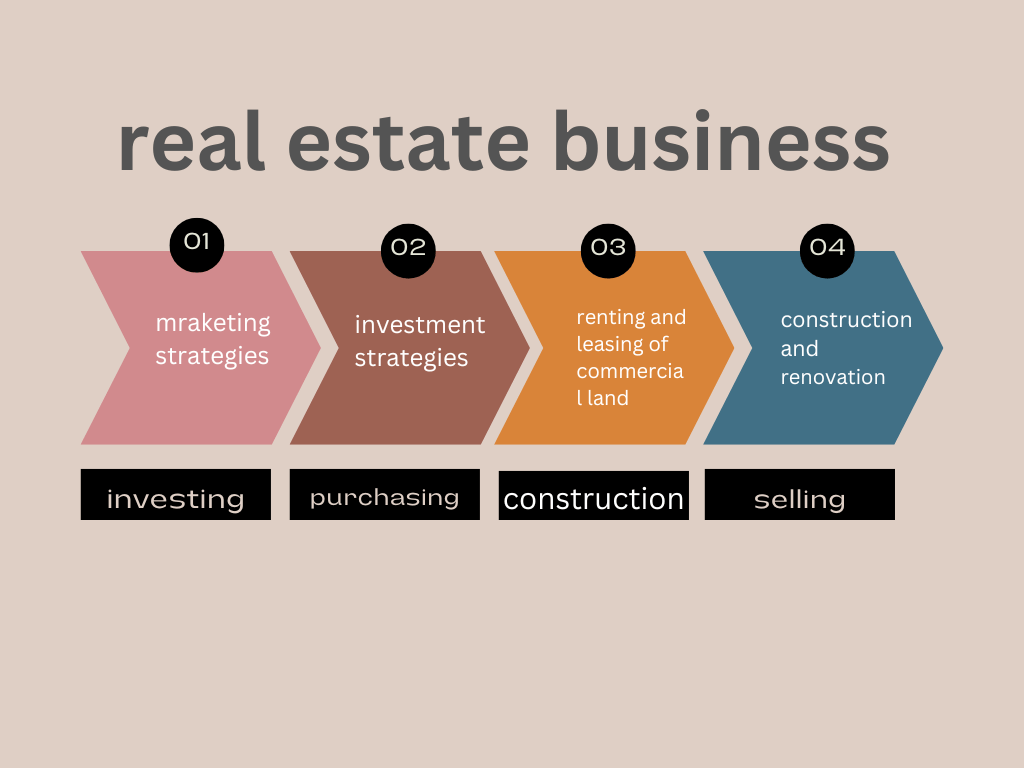

real estate include purchasing, management, leasing, or sale of properties. The only way to achieve success in the business includes market trends, property tax knowledge, and decision accessing strategies.

Types of Real Estate Investments

Real estate investments involve following types:

- Residential Real Estate: Includes single-family homes, condominiums, townhouses, and multi-family residences.

- Commercial Real Estate: business level properties are included in commercial real estate.

- Land: Undeveloped land purchased with the intention of future development or appreciation.

Strategies to Make Money from Real Estate

Following strategies proved result-driven in the field of real estate:

1. Rental Properties

Rental property is not a direct way of income. Rather it involves income on monthly basis in the form of rent payments. this type of real estate business involves buying of property and then selection of rent according to the area rates. There are no obligations for this type of property; you can either rent a home, building, shops, etc.

2. Flipping Houses

House flipping involves totally conversion of under-rated location house or buildings into highly valued ones. This process involves number of steps including purchase of property, renovation, re-construction, decoration. Although after whole development it may take some time to increase its value in the commercial market.

3. REITs authorities

REITs include all the companies managing real estates. In this type of investment you cannot control the ownership by your hand but receive proper income on regular basis either monthly, weekly or biannually. REITs are accessible to all individual investors at public level. It uses commercial stock exchange for trading.

4. Real Estate Development

Real estate development involves high funds for its progress. Because it involve development from head to toe. After its complete development, it becomes ready for sale or lease.

How to handle Real Estate

| Strategy | Description | Pros | Cons |

| Rental Properties | Generate passive income i.e. monthly rent payments. | Stable cash flow, potential for property appreciation. | Tenant management, property maintenance costs. |

| House Flipping | Buy low, renovate, and sell high for quick profits. | High profit potential in short timeframes. | Requires upfront capital, market timing risks. |

| REITs | Invest in real estate portfolios through publicly traded companies. | Diversification, liquidity, passive income from dividends. | Market volatility, dependency on management decisions. |

| Real Estate Development | Build or improve properties for sale or rental income. | Significant profit margins, creative control over projects. | High financial risk, regulatory hurdles, lengthy project timelines. |

| Short-term Rentals | Lease properties for temporary stays, often through platforms like Airbnb. | Higher rental income per night, flexibility in property use. | Seasonal demand fluctuations, regulatory restrictions in some areas. |

Key Considerations for Real Estate Investors

- Market Research: knowledge of property taxe and market trends.

- Financial Planning: Calculate potential returns, expenses, and financing options.

- Risk Management: Mitigate risks through diversification and thorough due diligence.

- Legal Compliance: Adhere to zoning laws, property regulations, and tax implications.

furthermore, One can become successful in the real estate business if he has deep insight in market trends and strategies for financial problems.it demands highly strategic thinking and decision-making mind. And then You can become the billionaire in your whole bloodline by this business if you manage your portfolio skillfully.

Conclusion

Real estate open number of gateways and opportunities for generating wealth. Even though, it is one of the difficult and challenging businesses. But once the business is stabilized, then it proved to be great profit-extracting. It is upon you that if you want long term but slow success i.e. by rental properties.

Although house flipping is quick way to generate profit but it requires a very high amount of funds at the back. There are number of strategies which can lead you to be overcome these challenges and hardship in the real estate business. Firstly, you should must be informed about present rates and trends of the property in the current market. Secondly, you must remain aware of the tax budgets.

Generally Asked Questions

1. name some rental properties that are best for rental income?

Some of the investing properties are proved to be great for in the field of real state such as single-family homes or multi-unit buildings in high-demand areas. These type of property normally offers consistent rental income.

2.Can someone invest in real state with limited funding?

Beginners can consider options like real estate funding, purchasing REITs. A beginner should invest by making partenership so that it will reduce the risk of losing to a great extent.

3.What measures should be taken before renovation of a house?

flipping of a house without checking may lead you to a loss .so the investors should carefully checkout the property’s condition, renovation costs, local market trends, and potential resale value to ensure a profitable investment.

4.Are there taxes applied to real state?

Yes, real estate investors have to pay number of such as property taxes, capital gains on the basis of sales, and deductions for expenses related to property management and maintenance.